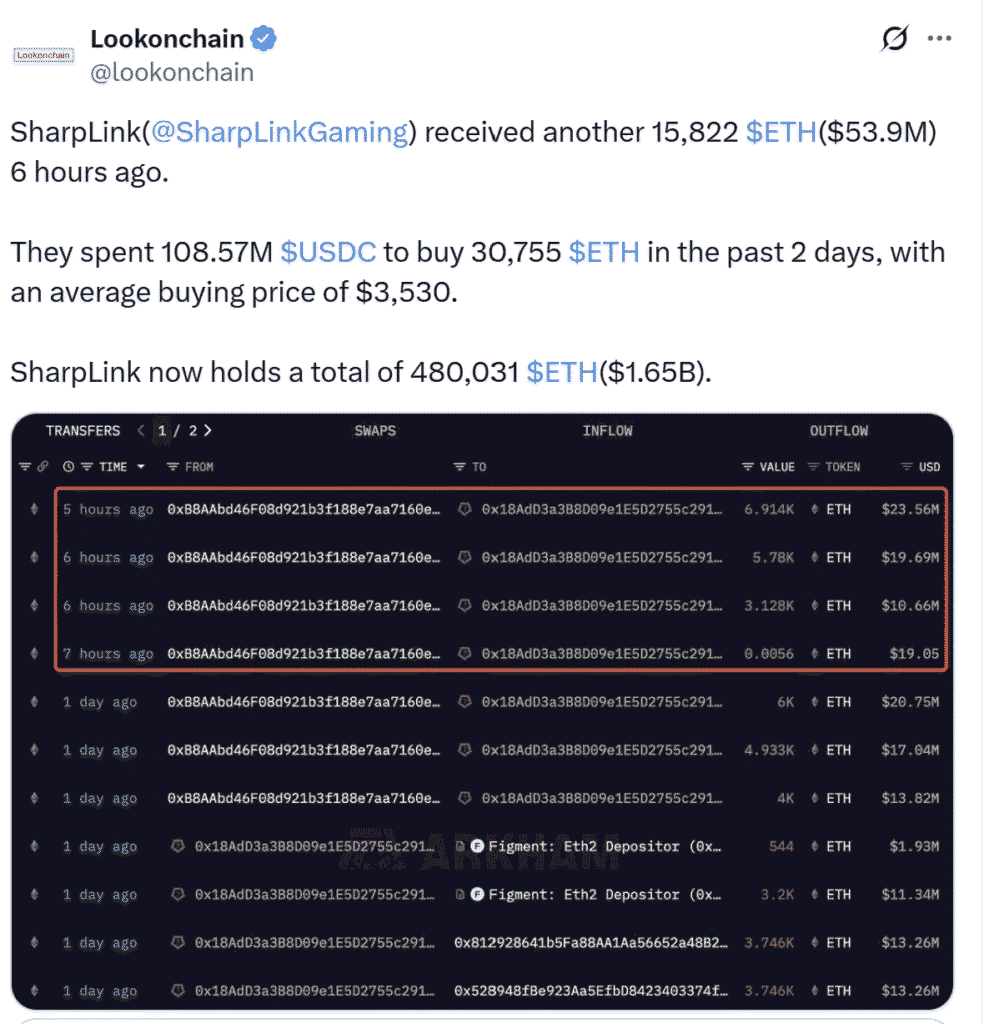

SharpLink raised its Ether holdings to approximately 480,031 ETH—worth $1.65 billion—after spending $108.6 million in USDC over 48 hours to acquire 30,755 ETH.

SharpLink has almost doubled down in a whirlwind 48-hour window, deploying $108.57 million in USDC to add 30,755 ETH to its treasury. This brings its total Ether assets to about 480,031 ETH, equivalent to $1.65 billion in value.

This move signals a renewed wave of corporate confidence in Ethereum’s long‑term potential—and growing belief in ETH as a treasury asset beyond Bitcoin.

Corporate Ether treasuries now hold around 1.09 percent of all ETH in circulation. That’s more than 1.3 million ETH across treasury firms. Meanwhile, Bitcoin treasuries hold 791,662 BTC, nearly $93 billion, or roughly 3.98 percent of the total BTC supply.

Institutional appetite for ETH is accelerating. Spot ETH ETFs in the U.S recently posted 19 consecutive days of net inflows—a record—totaling over $5.3 billion since early July. Analysts at Standard Chartered now project corporate firms may eventually hold 10 percent of all ETH, which would mark a tenfold increase from current holdings.

Related: Ethereum Outpaces Bitcoin Post‑GENIUS Act Boost

Ethereum’s 10th anniversary and ETF momentum

The surge coincides with Ethereum’s 10th anniversary, a symbolic milestone underscoring ETH’s evolution from ICO token to backbone of decentralized finance (DeFi), NFTs, staking, and tokenization.

Institutional investors view ETH as both a staking‑yield generator and a liquid reserve asset. That differentiates it from Bitcoin, which lacks native yield features. Corporate treasuries are increasingly turning to ETH to capture both store‑of‑value benefits and staking rewards.

ETF inflows have amplified liquidity, making ETH easily accessible to institutional and retail parties alike.

By sharply increasing its ETH reserve by over $1.6 billion, SharpLink raises Ether holdings, highlighting institutional conviction in Ethereum’s value both as liquid exposure and a yield-generating asset.

This move, paired with record ETH ETF inflows, marks a shift in corporate treasury strategies—positioning ETH at the center of institutional crypto adoption as the digital asset ecosystem enters a new phase of maturity.

Market reaction and price implications

Despite brief market volatility, derivatives data suggest the 2025 bull run remains intact. Bitcoin price recently dipped below $115K, triggering over $200 million in liquidations of leveraged long positions. Still, futures premiums stay within normal range, indicating caution but not bearish panic.

Ethereum’s renewed buying pressure—especially from treasuries and ETFs—could support optimistic year‑end targets. Standard Chartered sets a $4,000 target for ETH, driven partly by anticipated corporate accumulation.

If SharpLink and other major crypto entities continue scaling their ETH reserves, alongside growing demand from Ethereum ETFs, ETH could reach new all-time highs.

Enmanuel Cardozo, a market analyst at Brickken, noted that institutional adoption of ETH is “happening faster than with Bitcoin during its early treasury adoption phase.”

Standard Chartered analysts underscore regulatory arbitrage in ETH’s favor: corporate treasuries may find staking yields appealing—not offered by Bitcoin—making ETH an attractive long‑term reserve asset.

For readers, this means ETH is now playing a dual role: short‑term liquidity via ETF inflows and long‑term value retention via corporate reserves and staking.

What comes next?

Corporate ETH accumulation may scale further, pushing holdings closer to the Standard Chartered 10 percent estimate if the current pace persists.

Ethereum price could approach or exceed the $4,000 target if inflows maintain momentum and demand outpaces supply.

Nevertheless, macro headwinds—such as regulatory uncertainty, geopolitical tensions, or broader risk assets volatility—could weigh on gains. Market participants will be watching for ETF flows slowing or cash tightening in derivatives markets.