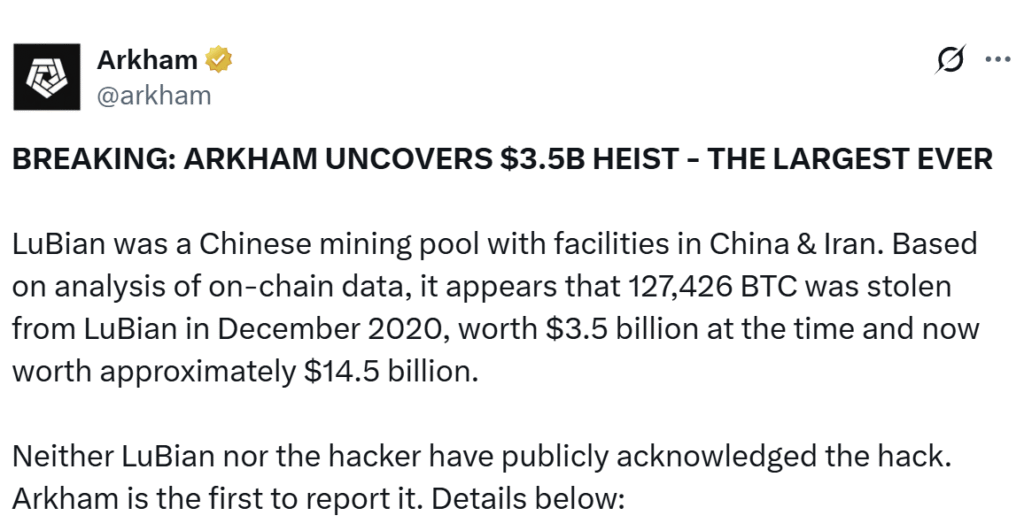

LuBian Bitcoin Heist unfolds as a blockchain shockwave. Arkham, a leading analytics firm, has revealed that in December 2020, approximately 127,426 BTC were stolen from LuBian, a major Chinese mining pool. That stash, initially worth about $3.5B, has appreciated to an estimated $14.5B — and the theft remained undetected for nearly five years.

According to Arkham, the attacker drained over 90% of LuBian’s BTC holdings on December 28, 2020, followed two days later by a smaller theft of roughly $6M worth of BTC and USDT via the Bitcoin Omni layer. LuBian reportedly shifted its remaining 11,886 BTC into recovery wallets by December 31, 2020.

Arkham attributes the breach to weak private key generation, which is potentially vulnerable to brute‑force attacks. This early mining infrastructure flaw allowed the stealthy extraction—raising serious concerns about the security of legacy key‑management systems in major mining pools.

What the LuBian Bitcoin Heist Means Now

The LuBian Bitcoin Heist is arguably the most significant crypto theft in history. With most of the stolen coins untouched and still traceable on-chain, speculation is mounting. LuBian’s team made quiet on-chain pleas for the return of funds, though no public disclosures occurred until Arkham’s report.

This case highlights a persistent truth: legacy crypto infrastructure may contain latent vulnerabilities, particularly around key management and wallet generation. As the value of stolen BTC multiplies, regulators and platforms are likely to revisit compliance, audit, and custody standards to prevent similar breaches. Businesses and users alike may need to validate how keys are generated and stored, especially in institutional contexts.

Related: Crypto Hack Losses Surge $142M in July 2025

Market Reaction

Despite Bitcoin’s recent price decline—sliding below $115K after weak U.S. jobs data and macroeconomic uncertainty—experts remain cautious but not sceptical of long-term fundamentals. Analysts like Tom Lee of Fundstrat/Bitmine see institutional accumulation continuing strongly, while suggesting Bitcoin could revisit $250K if the Fed eases rates.

However, the LuBian breach may inject a new risk-sensitive tone in institutional forums, reinforcing focus on on-chain transparency, custody rigor, and private key practices.

The LuBian Bitcoin Heist stands as a stark reminder of how early cryptographic vulnerabilities can carry enduring, high‑stakes risk. The breach sheds light on legacy weaknesses and emphasizes the importance of secure key generation and robust monitoring. As regulators and institutions reassess safeguards, this event may shape standards—and expectations—for years to come.