Dogecoin institutional accumulation is making headlines today as DOGE plunged roughly 8% before large wallets stepped in to buy near $0.21. The meme‑token’s fall and rebound highlight a tug‑of‑war between heavy liquidation and strategic accumulation by large holders.

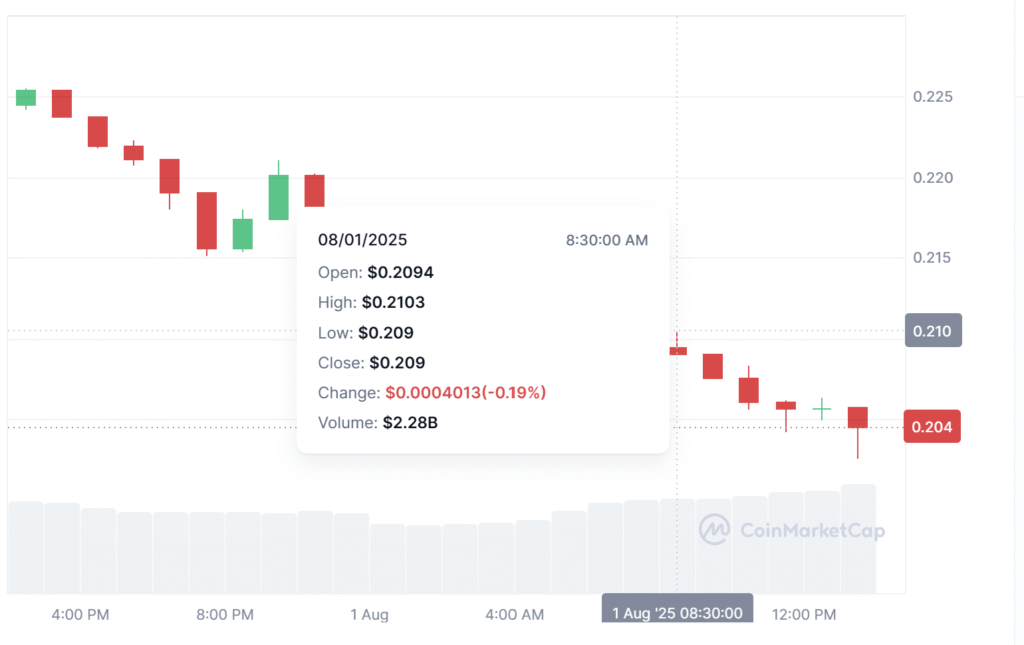

DOGE slipped from about $0.22 to $0.21 within 24 hours, marking one of its steepest drops this month. Trading volume spiked to approximately 1.25 billion DOGE—well above the daily average of 365 million—suggesting forced liquidations and cascade selling across leveraged positions.

Despite the sell‑off, on‑chain data reveals institutional wallets bought around 310 million DOGE during the downturn. This accumulation near the $0.21 support level signals conviction from large holders even at lower prices.

The sharp decline triggered short‑term pain for retail traders but provided a window for institutions to increase exposure. Analysts note that such accumulation amid volatility often precedes short‑term rebounds or consolidation phases. While DOGE lost value initially, the buying by smart money suggests confidence in its mid‑term potential.

Dogecoin remains highly sensitive to sentiment swings. This drop follows broader crypto weakness: BTC, ETH, XRP and SOL also declined by 6% as bullish bets worth over $600 million were liquidated across the market. As altcoins suffer, DOGE sees heightened volatility and reactive trading.

Crypto traders describe DOGE as a high‑beta asset—its moves amplified compared to larger tokens. A market analyst remarked that institutional buy‑in during sell‑offs indicates a rotation from speculative longs into longer‑term positions. DOGE holders are waiting to see if support holds at $0.21–$0.20; failure below this could trigger further downside. Yet the swift recovery suggests those levels remain meaningful.

What Traders Should Know

For existing DOGE investors: the $0.21 level likely represents a key technical support. The rebound driven by major wallets may help cushion further downside. For those exploring entry points: this dip‑and‑accumulate dynamic could offer a buying opportunity—but only if broader market volatility subsides.

In short, DOGE’s 8% fall wasn’t just a washout—it also served as a staging ground for institutional accumulation. That mix of liquidations and strategic buying underscores why DOGE attracts both short‑term traders and long‑term speculative investors alike.

Read Also: Alchemy’s Cortex Engine Cuts Stablecoin API Latency by 66%