Quick Summary

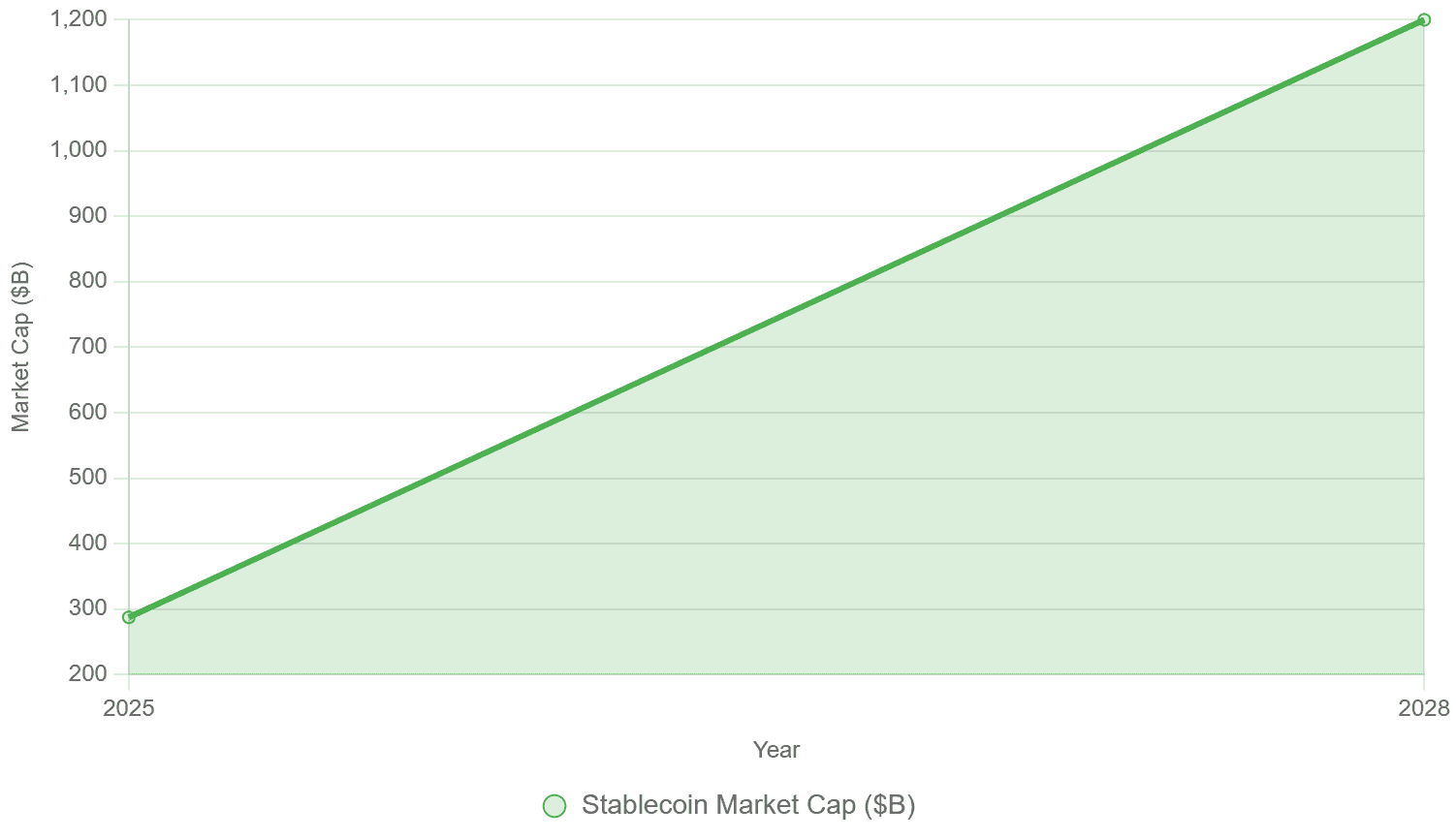

Coinbase forecasts stablecoin market to reach $1.2 trillion by 2028.

U.S. regulations, like the GENIUS Act, drive growth.

Stablecoin issuers may need $5.3 billion weekly in Treasury bills.

Global competition sparks interest in non-dollar stablecoins.

Who: Coinbase, stablecoin issuers like Tether and Circle.

What: Stablecoin market projected to hit $1.2 trillion by 2028.

When: Forecast for 2028, with GENIUS Act effective in 2027.

Where: U.S. and global markets, including South Korea and China.

Why: Regulatory clarity and rising adoption fuel growth.

Bullish View: Stablecoin growth boosts crypto adoption and financial innovation.

Bearish View: High Treasury demand could strain U.S. debt markets.

Skeptical View: Projections may overestimate adoption without global regulatory alignment.

| Key | Value |

|---|---|

| Market Projection | $1.2 trillion by 2028 |

| Current Market Cap | $287.56 billion (2025) |

| Weekly Treasury Demand | $5.3 billion |

| Key Regulation | GENIUS Act (2027) |

Coinbase predicts the stablecoin market will soar to $1.2 trillion by 2028, nearly a fivefold jump from today’s $287.56 billion. This bold forecast hinges on clear U.S. regulations and growing global demand for digital currencies pegged to fiat.

Stablecoin Market Growth Fueled by Regulation

The U.S. GENIUS Act, set to take effect in 2027, mandates one-to-one reserves and audits for stablecoin issuers. This law aims to curb risks like destabilizing runs. Coinbase says it will boost trust, driving adoption. The exchange’s research, led by David Duong, used 20,000 simulations to map growth paths.

Stablecoin issuers like Tether and Circle rely on U.S. Treasury bills to back tokens. To hit $1.2 trillion, they’d need $5.3 billion in weekly Treasury purchases. This could trim three-month Treasury yields by 4.5 basis points, a minor dip.

Global Race for Stablecoin Dominance

U.S. dollar-pegged stablecoins lead, but other nations are catching up. South Korea plans a regulatory bill in October. China may allow yuan-backed stablecoins in zones like Hong Kong. These moves aim to rival the dollar’s digital dominance.

Tether’s USDT holds a $150 billion market cap, while Circle’s USDC has $60 billion. Both outpace many countries in buying U.S. debt. In 2025, stablecoin issuers rank among the top buyers of Treasury bills, surpassing nations like South Korea.

However, risks loom. Sudden redemptions could force issuers to sell Treasuries fast, stressing markets. The GENIUS Act won’t grant access to Federal Reserve liquidity, leaving issuers exposed.

Stablecoins are no longer just crypto tools. They power payments and remittances. Their growth could reshape global finance, but only with steady regulation. Coinbase’s forecast sees adoption compounding, not spiking.

Yet, not all agree. JPMorgan predicts a smaller $500 billion market by 2028, citing slow payment adoption. The U.S. Treasury earlier estimated $2 trillion, showing varied outlooks. Coinbase’s $1.2 trillion sits in the middle, balancing optimism with caution.

The stablecoin market’s path depends on policy and trust. If regulations align globally, $1.2 trillion could be conservative. But any misstep risks slowing this digital cash revolution.

Also Read: Thai Police Bust Korean National in $50 Million Crypto Gold Laundering Scheme