The launch of Chainlink Data Streams sent LINK’s price up by nearly 4%, as the protocol introduced a new oracle service linking US equities and ETFs. The LINK token gained momentum today amid a broad market correction and renewed investor interest.

Chainlink Data Streams enables on-chain access to live pricing from equity and ETF markets. It is a significant step towards connecting traditional financial data with blockchain applications.

The new service launch comes just as Bitcoin and other altcoins are surging after weekend volatility. With LINK up 4% at the start of the week, analysts are pointing to further bullishness from technical indicators.

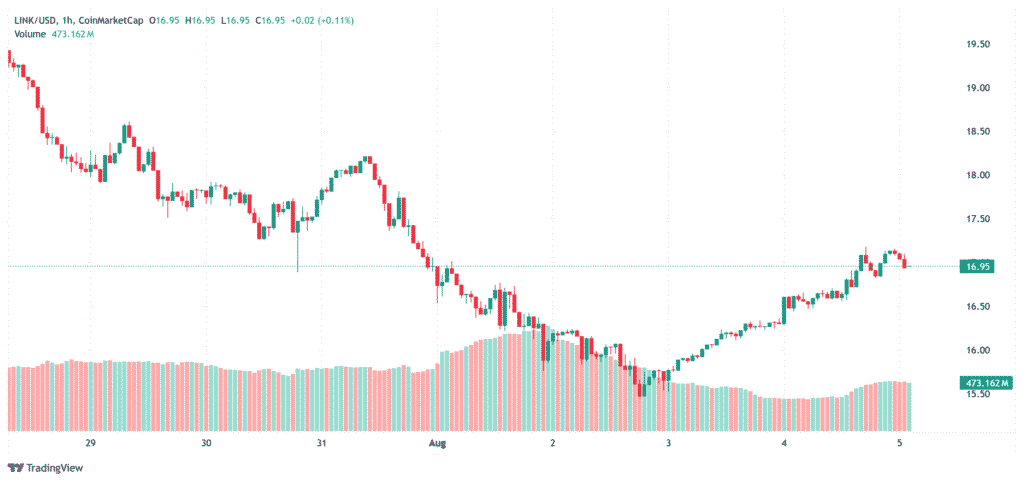

Chainlink (LINK) is trading at $16.95, up 4% in 24 hours. This surge in price coincides with the launch of data streams on the Scroll platform.

Chainlink has long been providing oracles for DeFi protocols. With its Data Streams launch, Chainlink now offers real-time data feeds directly linked to indexed US stocks and ETFs. This opens up possibilities for tokenized asset platforms, automated trading strategies, and hybrid CeFi DeFi applications. As global interest in tokenization grows, Chainlink is becoming a key infrastructure player.

The timing is in line with the growing demand for traditional asset data in decentralized systems. Asset tokenization is on the rise in the real world, and live feeds can power smart contracts based on share prices, ETF NAVs, or market benchmarks. Chainlink’s move puts it at the center of this trend.

Market reaction and expert views

Link’s price surge represents more than just a recovery from broader crypto weakness. Markets welcomed the announcement as confirmation of Chainlink’s growing use case. CoinDesk Research indicated that technical momentum is picking up, and volume is supporting a breakout after the weekend’s slump.

Traders and liquidity providers responded quickly. The integration of tokenized financial use cases has long been expected, and the Chainlink Data Stream launch could accelerate adoption. Institutional players looking to connect on-chain logic with real-world assets can now find on-chain data to be reliable and auditable.

Read Also: SharpLink Raises Ether Holdings to $1.65B with Latest $54M ETH Buys

What the launch means for traders and developers

Developers building on Ethereum or other smart contract chains now have standardized, up-to-date data feeds for equity and ETF pricing. This could make new decentralized structured products and index-linked tokens possible. Users could find better transparency and lower latency in DeFi apps connected to traditional markets.

As protocol adoption spreads, token holders could see an increase in demand for LINK. As the use of data streams grows, token economics could support staking, validation, or fee-based incentives around these feeds.

The Chainlink data streams launch comes at a time when digital asset markets are looking for deeper integration with traditional finance. Bitcoin and altcoins are recovering from weekend declines, but as ETF flows return and DeFi matures, the connectivity between blockchain and real-world assets could define the next phase of growth.