Brazil’s government is considering the creation of a national bitcoin reserve, a move that could reshape the country’s fiscal strategy and advance blockchain infrastructure.

National Bitcoin Reserve Plans Gain Momentum

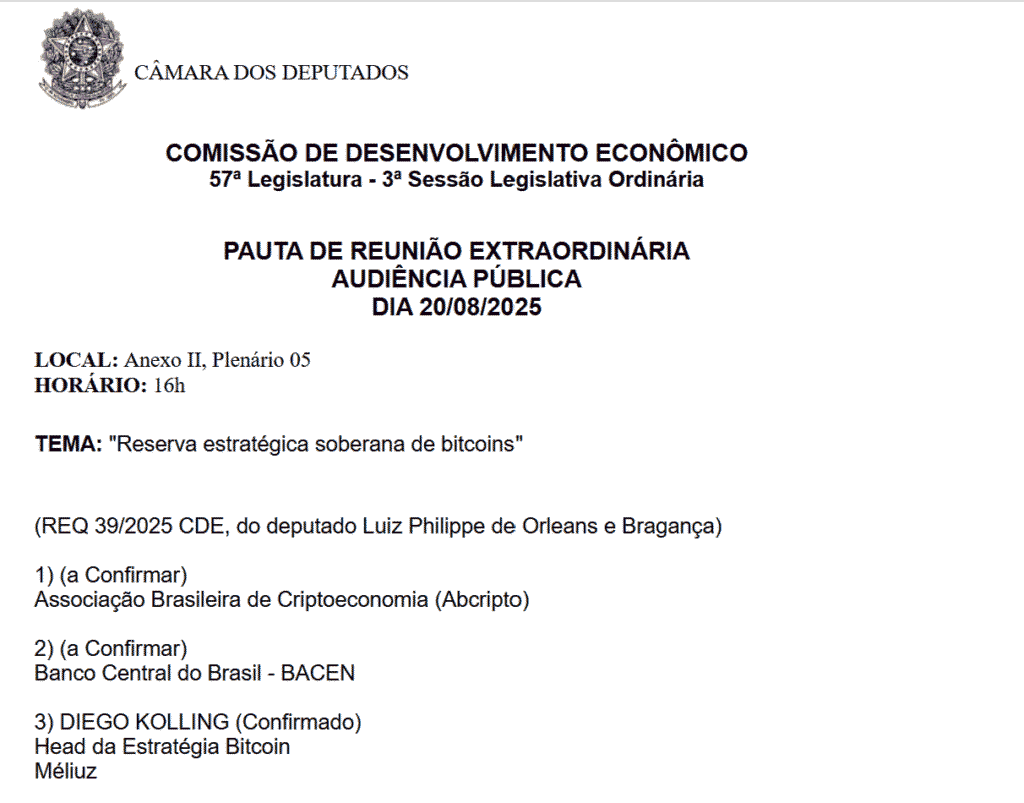

Brazil is exploring plans for a national bitcoin reserve linked to its treasury. A high-level public hearing is scheduled for August 20, 2025.

The bill proposes allocating up to 5 percent of Brazil’s $300 billion treasury reserve to Bitcoin, aiming to safeguard reserves against currency swings and geopolitical risk.

This proposed national bitcoin reserve follows similar initiatives in the United States, which created a Strategic Bitcoin Reserve via executive order in March 2025. The Brazilian proposal aligns with a growing trend among global governments to treat Bitcoin as a strategic asset rather than a speculative digital currency.

Why A National Bitcoin Reserve Matters To Brazil

A properly managed national bitcoin reserve could offer Brazil an alternative safeguard against inflation and foreign exchange volatility.

Government officials argue that Bitcoin’s decentralized nature makes it a useful hedge amid shifting global capital flows. At the hearing, lawmakers should debate both the possible upside and legal implications of such an allocation.

Additionally, the proposal reflects Brazil’s ambition to adopt fintech innovation, including the possible reclassification of crypto assets under financial regulation. Experts suggest the move would promote institutional adoption without exposing state coffers to undue risk.

Financial analysts note that government adoption lends legitimacy and long‑term confidence to crypto markets.

Brazilian national bitcoin reserve, even if just built from seized assets or a small treasury allocation, could reduce perceived risk and inspire financial innovation.

Timeline and stakeholders

- August 20, 2025: Congress hearing on the national bitcoin reserve bill

- Supporters include pro‑crypto legislators arguing on financial diversification and modernization

- Critics question volatility, custodial security, and long‑term reserve stability

Brazil’s House of Representatives must deliberate on this bill and consider precedents such as the U.S. Strategic Bitcoin Reserve and provisions under its own laws.

If approved, the Brazilian national bitcoin reserve may encourage other nations to explore similar strategies. It also signals to institutional investors that Latin America is open to crypto integration at the governmental level.

Brazil’s consideration of a national bitcoin reserve comes amid broader global regulatory momentum. In the U.S., the SEC has allowed in‑kind creations and redemptions for spot Bitcoin and Ethereum ETFs. The CFTC has also approved spot crypto trading on registered futures exchanges under “Project Crypto”.

These developments reflect growing institutional infrastructure and evolving policy frameworks for digital assets.

Read Also: BDACS Enables Institutional XRP Custody in Korea: Big Boost for XRP Trustworthiness