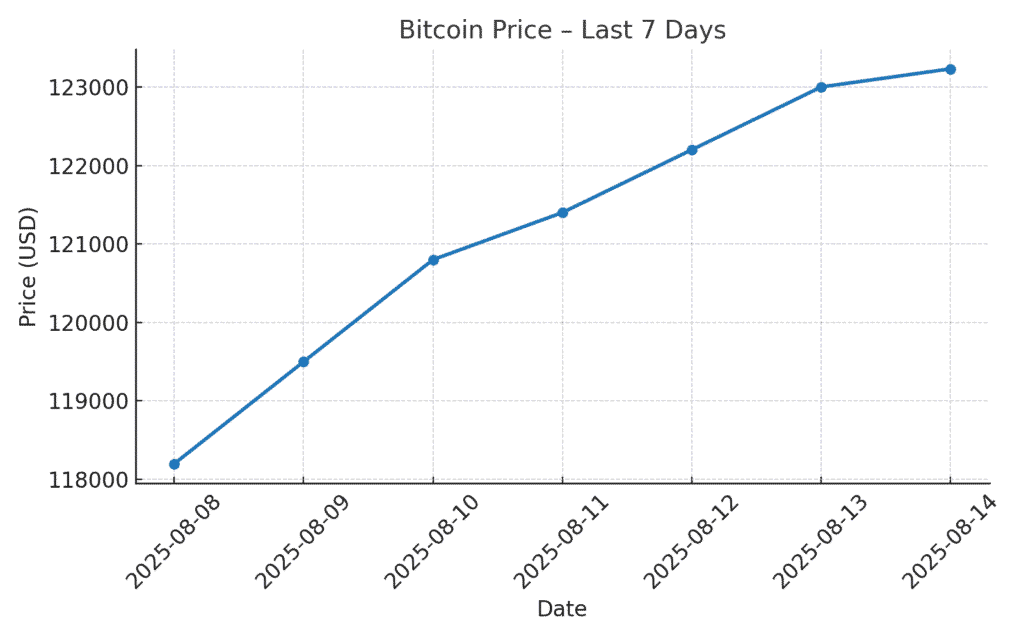

Bitcoin has set a new record, climbing to $123,231 on Coinbase in early Wednesday trading.

The move pushed the total cryptocurrency market capitalization to $4.15 trillion, reflecting renewed momentum across the sector.

The rally comes amid strong inflows into exchange-traded funds (ETFs), easing inflation tensions in the U.S., and a wave of probable short liquidations that could accelerate gains.

Inflation Data Fuels Rate Cut Hopes

The latest U.S. Consumer Price Index (CPI) report showed July inflation holding steady at 2.7% year-on-year, matching June and coming in below analyst expectations.

This has boosted the market’s confidence that the U.S. Federal Reserve could cut interest rates sooner than previously thought. Data from the CME FedWatch Tool now shows a 93.9% probability of a September rate cut.

Lower interest rates typically make risk assets like Bitcoin more attractive, as investors look for higher returns in non-traditional markets.

Analysts also point to possible fiscal policies under the current U.S. administration — including higher government spending and inflation tolerance — as supportive of Bitcoin’s long-term growth.

Institutional Demand Surges Through ETFs

Institutional capital continues to flow into Bitcoin and Ether ETFs at an aggressive pace. On Tuesday alone, Bitcoin ETFs recorded $65.9 million in net inflows, while Ether ETFs attracted $523.9 million.

The Ether ETF milestone was significant, with the first-ever $1 billion single-day inflow, highlighting the broader strength of the crypto ETF market.

Since last Friday, Bitcoin ETFs have seen more than $1.02 billion in total inflows, according to market trackers.

Rising ETF demand not only signals growing mainstream adoption but also creates consistent buying pressure in the spot market — a key driver behind Bitcoin’s price climb.

Short-Sellers Face $2 Billion Liquidation Risk

On-chain analytics show a concentration of short positions in the $122,500–$124,000 price zone. If Bitcoin pushes firmly through this level, it could trigger nearly $2 billion in forced short liquidations.

Liquidations happen when traders betting against the asset (short-selling) are forced to buy back their positions to cover losses, effectively adding upward momentum to the market.

Analysts suggest that if this liquidation cluster is cleared, Bitcoin could quickly test the $125,000–$128,000 range in the coming days.

Why $125K Matters

The $125K mark is not only a psychological barrier but also an important technical level.

Breaking through could set a stronger support base for Bitcoin, potentially setting the stage for higher targets later this year.

Some traders are already eyeing the $130K–$135K range as a mid-term goal, provided macroeconomic conditions remain favorable and ETF inflows stay strong.

Market Outlook

With ETF inflows at record levels, inflation under control, and the Federal Reserve leaning toward rate cuts, Bitcoin appears well-positioned for further gains.

However, volatility remains high, and any sudden macroeconomic shifts or profit-taking could spark pullbacks.

Still, the current mix of macro optimism, institutional demand, and short-squeeze potential is creating one of the most bullish backdrops for Bitcoin in recent years.

Bitcoin is trading in record territory, and a wave of short liquidations could give it the push it needs to reach $125K. With ETF flows surging and rate cuts on the horizon, the market’s focus is now on whether this rally can carry into the next leg higher.

Also Read: Ethereum Gains Momentum, Bitcoin Stable Near $118K