Bitcoin and Ethereum ETFs outflows took center stage as both Bitcoin and Ethereum funds posted their second‑largest daily redemptions of 2025. Investors withdrew approximately $812 million from Bitcoin ETFs, while Ethereum funds saw $153 million in outflows, ending a robust 20‑day inflow streak.

The redemptions came just days after significant regulatory developments, including approval of in‑kind creations and redemptions for spot ETFs and the launch of the SEC’s Project Crypto initiative. Analysts called it an “odd end” to what might have been “perhaps the most important week ever” for crypto’s regulatory evolution.

The discrepancy between pouring inflow momentum and sudden reversal underscores a fragile investor sentiment, especially given the HBO to ETF linkage, deep liquidity, and trading cost efficiency now baked into the ETF structure.

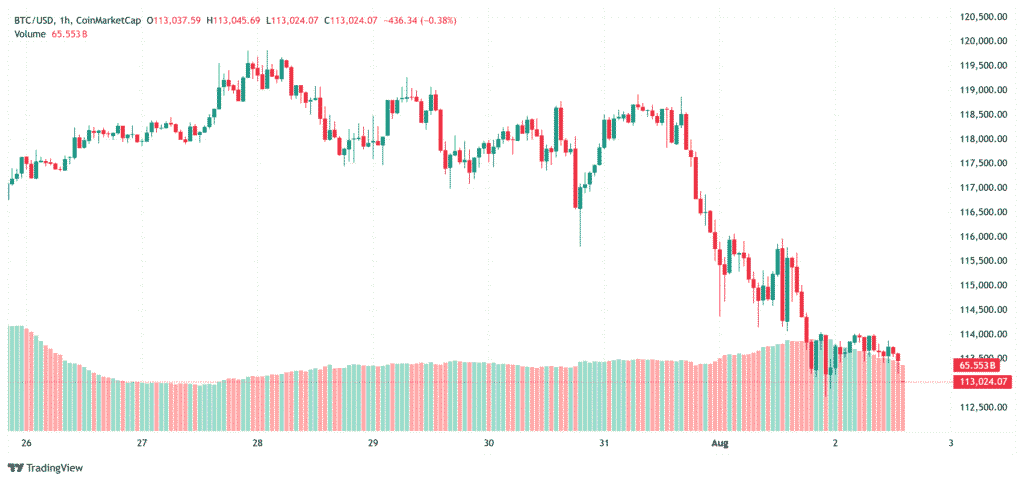

Following the redemptions, Bitcoin prices slipped to around $113k , and Ethereum fell to $3,500. Over the past 24 hours, the total crypto market cap declined by nearly 1.9% to about $3.69 trillion, with trading volume surging amid volatility.

Traders faced approximately $615 million in crypto liquidations, primarily in long positions, with Ethereum accounting for $234 million of these losses.

In this environment, seasoned institutional investors like Bitmine’s Tom Lee continue to spot opportunities, citing quiet accumulation by Wall Street and long‑term targets of $250 k BTC and $10 k ETH.

An ETF’s structural mechanics—like in‑kind redemption—help shield against tracking error and reduce costs. But those same mechanics can magnify volatility when confidence collapses. Investors who previously saw these ETFs as stable entry points are facing the reality of crypto’s still‑nascent risk profile.

The SEC’s launch of Project Crypto signals longer‑term clarity and support, but short‑term technical flows and sentiment still dominate market activity.

Will Inflows Resume?

July was historic: in July 2025, Bitcoin and Ethereum ETFs together saw record inflows (Bitcoin and Ethereum amassed over $12 billion). But August began with a sell‑off. Analysts expect further volatility but see the broader trend still intact.

If Project Crypto yields concrete guidance and macro risk subsides, inflows may return. Tom Lee and others believe institutional accumulation is only in the early innings.

Bitcoin and Ethereum ETFs outflows have delivered a jarring wake‑up call: even with strong structural momentum and regulatory tailwinds, investor sentiment remains fragile. Large redemptions, combined with macro uncertainty, fueled sharp price moves and forced liquidations. As regulatory clarity unfolds and institutional buyers quietly accumulate, long‑term cases remain intact—but volatility is no stranger in today’s crypto markets.

Read Also: Arthur Hayes Sells $13 M Crypto, Warns of $100K BTC & $3K ETH Dip