Institutional XRP custody is now live in South Korea thanks to a new partnership between Ripple and BDACS, marking a positive milestone for institutional XRP adoption.

This launch allows institutional investors to securely custody XRP in Korea, reinforcing institutional XRP custody infrastructure and strengthening regulatory trust.

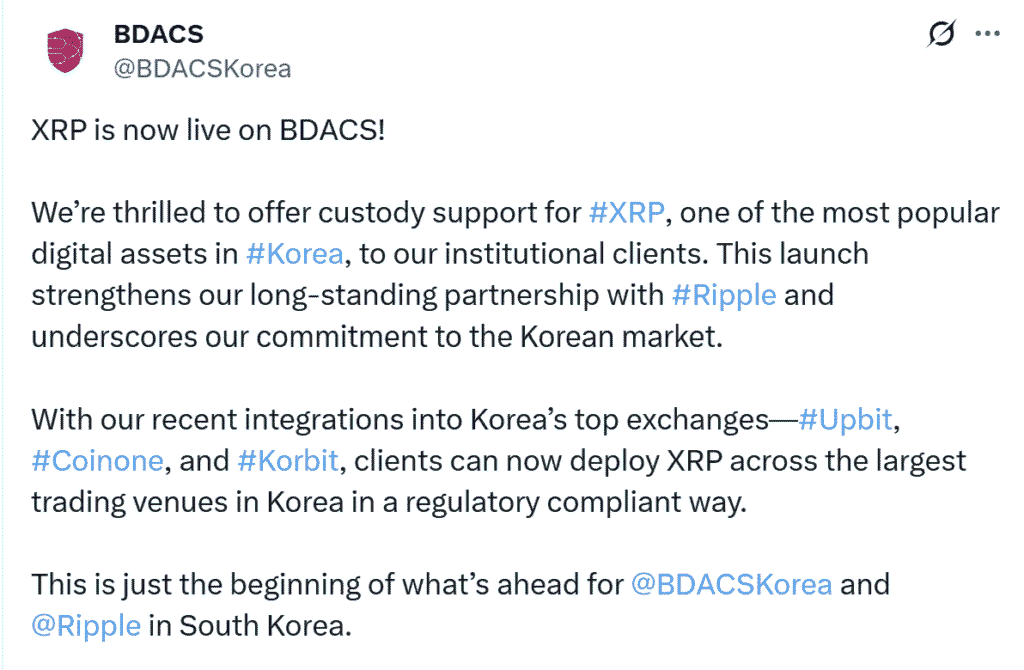

Ripple and BDACS have officially introduced XRP custody services tailored for institutions seeking regulated storage and asset protection in the Korean market.

Institutional XRP Custody Expands in Korea

The new custody solution aims to provide regulated, secure vaulting services for institutional clients handling XRP. By aligning custody systems with local regulatory requirements, BDACS and Ripple have created a framework designed to support institutional flows and asset integrity.

This initiative positions institutional XRP custody as a possible option for institutional capital in Asia, where regulation and trust are key factors for adoption.

Ripple and BDACS finalized their partnership in early August 2025, aligning with broader moves toward regulatory clarity in the XRP legal saga. The launch follows Ripple’s decision in June to drop its cross‑appeal against the SEC, signaling an end to its legal battle and greater regulatory alignment.

This news arrives shortly after the SEC staff issued a statement affirming that some forms of liquid staking do not violate securities laws — a stance that may indirectly influence custody and institutional services in the crypto sector.

For institutions, custody is the foundation of asset participation. The availability of institutional XRP custody on a regulated platform in Korea reduces friction, increases transparency, and adds legitimacy to XRP’s institutional use.

Informed investors see this as a trust enhancer. The regulated custody solution may attract more institutional players into XRP holdings, potentially expanding market depth and liquidity.

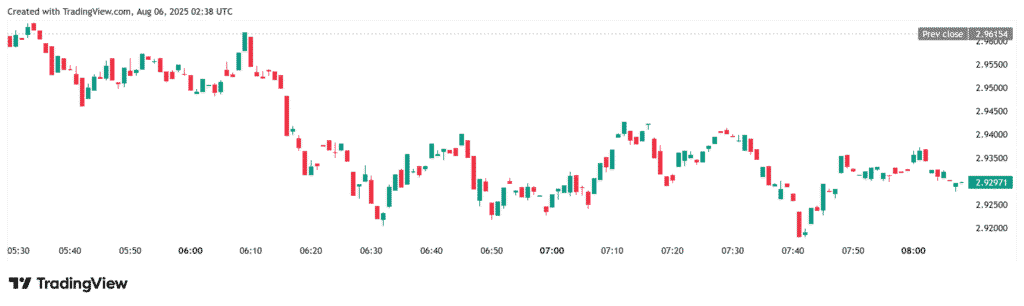

Market Reactions and Price Impact

XRP trading activity mirrors rising interest. On August 5, CoinDesk Analytics reported that XRP traded up to $3.11 before reversing sharply on high volume (69.89 million XRP).

High session volume coupled with new institutional infrastructure points to growing speculative and long-term interest among investors watching institutional XRP custody developments.

Read Also: Spot Ethereum ETF Outflows Reach $465 Million in Single Day

While no public quotes have been released specifically from Ripple or BDACS executives, analysts view the move as consistent with global institutional rollout strategies. The establishment of regulated custody in a primary crypto market sends positive signals to global institutions evaluating XRP exposure.

Beyond institutional adoption, institutional XRP custody in Korea contributes to broader XRP integration across emerging regulated frameworks. It may pave the way for similar custody offerings in other jurisdictions, especially where governance and compliance matter to institutional clients.

Coupled with decreasing legal uncertainty after the SEC‑Ripple settlement shift, the custody offering supports a momentum shift toward XRP as an institutionally tradable asset.