The cryptocurrency market continued its bullish momentum today, with Ethereum (ETH) stealing the spotlight. Analysts, institutional investors, and traders are increasingly confident about ETH’s long-term trajectory, while Bitcoin (BTC) remains steady above the $118,000 level. Several other leading altcoins also posted gains, fueled by optimism across the sector.

Standard Chartered Lifts Ethereum Forecast to $7,500

Global banking giant Standard Chartered has raised its 2025 Ethereum price target from $4,000 to $7,500. The bank cited multiple drivers for this upward revision:

- Strong institutional buying, primarily through spot ETH exchange-traded funds (ETFs) in the United States.

- Ongoing Ethereum network upgrades aimed at improving scalability and reducing costs.

- The rising adoption of stablecoins built on Ethereum’s infrastructure is notable.

The report highlights that major U.S. companies are starting to hold ETH in their treasuries, a move previously seen mainly with Bitcoin. Analysts believe this shift could accelerate demand over the next 12 to 18 months.

Traders Show “Disbelief” as Big Players Accumulate

Despite ETH’s recent rally, on-chain data from Santiment shows many retail traders remain skeptical and continue selling. This so-called “disbelief rally” has created opportunities for large investors and whales to accumulate ETH at favorable levels.

A large group of 7 whale siblings recently sold 19,461 ETH (worth around $88 million) in just 15 hours. However, they still hold a massive $5.6 billion in ETH, suggesting confidence in Ethereum’s long-term potential.

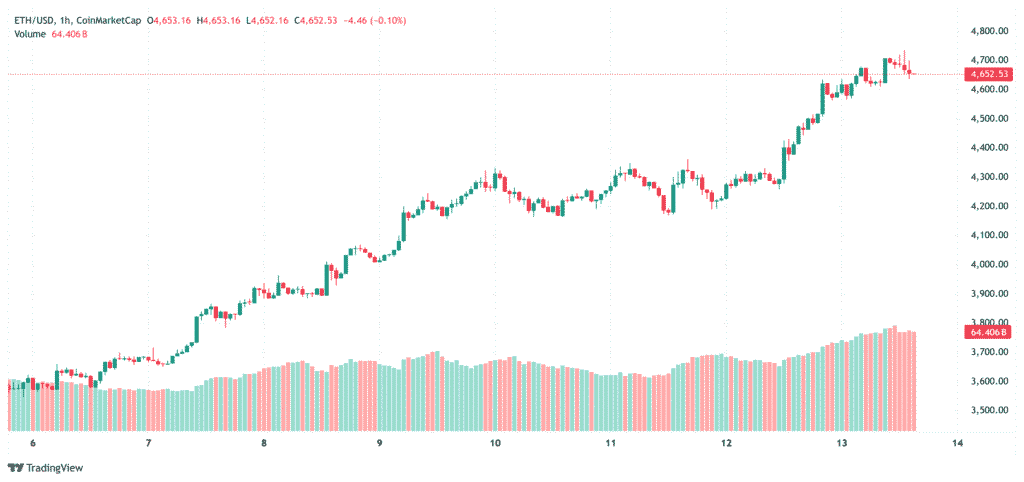

Price Surge Puts All-Time High in Sight

ETH surged nearly 10% over the past day, trading close to its November 2021 all-time high of $4,867. Market momentum has been supported by more than $2.3 billion in ETF inflows over the past six days.

Some market strategists are now predicting Ethereum could climb to $13,000 in the next major bull run. Adding to the bullish tone, BitMine, a venture led by Wall Street veteran Tom Lee, has announced plans to acquire up to $25 billion in ETH over the coming years.

Bitcoin Stability Helps Altcoins Rally

Bitcoin held steady at around $118,000, creating a stable backdrop for altcoin gains. Coins like Binance Coin (BNB), Chainlink (LINK), and Uniswap (UNI) saw renewed buying interest, with traders eyeing potential breakouts if BTC remains stable.

Market analysts note that when Bitcoin consolidates at high levels, altcoins often outperform in the short term. This trend appears to be developing again, with several mid-cap coins showing early signs of upward momentum.

Regulatory & Legal Updates Impact Sentiment

The crypto sector also faced significant regulatory and legal developments:

- Terraform Labs co-founder Do Kwon pleaded guilty in the U.S. to wire fraud and conspiracy charges related to the collapse of TerraUSD. His sentencing is set for December 11, and he faces up to 25 years in prison, though prosecutors may recommend no more than 12 years.

- U.S. banking associations are urging Congress to address a big loophole in the GENIUS Act that could allow stablecoin issuers to pay yield through affiliated entities, bypassing existing restrictions.

While these events introduce a degree of caution, market participants appear focused on the ongoing price momentum in major cryptocurrencies.

Outlook: Momentum Meets Macro Risks

Ethereum’s rapid climb, combined with record-breaking ETF inflows, signals strong market confidence. However, analysts warn that short-term volatility remains possible—especially if macroeconomic data or regulatory headlines shift sentiment.

For now, traders are watching whether ETH can break its all-time high and sustain above it. If that happens alongside continued Bitcoin stability, the broader crypto market could see one of its strongest quarters in years.

Also Read: NFT Market Cap Hits $9.3B as Ethereum Price Surge Lifts Valuations