Circle, the issuer of USD Coin (USDC), has announced plans to launch a new Layer-1 blockchain called Arc later this year.

The platform is designed specifically for stablecoin payments and finance, with a focus on speed, privacy, and integration with existing financial systems.

Arc will be Ethereum Virtual Machine (EVM) compatible, allowing developers to build or move applications from Ethereum easily. Arc will use USDC as its native gas token, meaning all transaction fees can be paid in USDC rather than a separate cryptocurrency.

Built for Stablecoin Payments

Circle says Arc will feature a built-in foreign exchange (FX) engine to allow instant swapping between stablecoins. It will also offer sub-second transaction finality, making payments faster than most existing blockchains.

The network will include opt-in privacy, giving users control over whether their transactions are public or private. Arc will be deeply integrated with Circle’s existing services, including its APIs and payment infrastructure, while maintaining interoperability with other blockchains.

Speaking about the launch, Circle’s co-founder and CEO Jeremy Allaire said the company aims to “set a new standard for stablecoin utility” by creating a blockchain optimised for real-world payments and digital commerce.

Q2 Financial Results Show Strong Growth

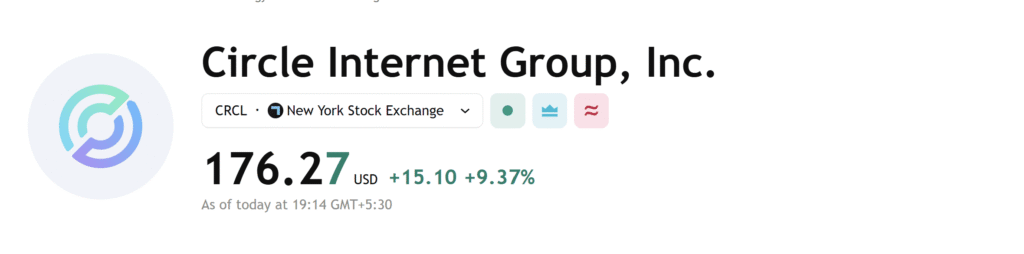

The announcement came alongside Circle’s second-quarter 2025 earnings report, its first since going public earlier this year.

Revenue and reserve income for the quarter grew 53% year-over-year, reaching $658 million. Circle also reported that USDC in circulation increased 90% from last year, standing at $61.3 billion at the end of June and rising further to $65.2 billion by August 10.

The company posted an adjusted EBITDA of $126 million, up 52% compared to the same quarter in 2024. However, Circle also recorded a net loss of $482 million, driven mainly by one-time IPO-related non-cash expenses, such as stock-based compensation.

Market Reaction

Investors responded positively to the earnings and the Arc announcement. Circle’s stock rose 5–7% in early trading following the news.

Market analysts noted that Arc’s launch could strengthen USDC’s role in payments and boost transaction volumes, which would support Circle’s long-term revenue growth.

USDC is currently the second-largest stablecoin by market capitalization, following Tether’s USDT. With Arc, Circle is positioning itself not just as a stablecoin issuer but as a key infrastructure provider in the digital payments ecosystem.

What’s Next for Circle

Arc is expected to launch later in 2025, with Circle targeting both retail and institutional adoption. The company will continue expanding USDC’s reach across payment processors, fintech apps, and global banking networks.

If successful, Arc could mark a significant shift in how stablecoins are used — moving from mainly crypto trading to mainstream digital finance and cross-border payments.

Also Read: Tether and Rumble Target AI Growth With $1.17B Northern Data Deal