Ether (ETH) has crossed the $4,000 mark for the first time since December 2024, signaling renewed strength in the world’s second-largest cryptocurrency.

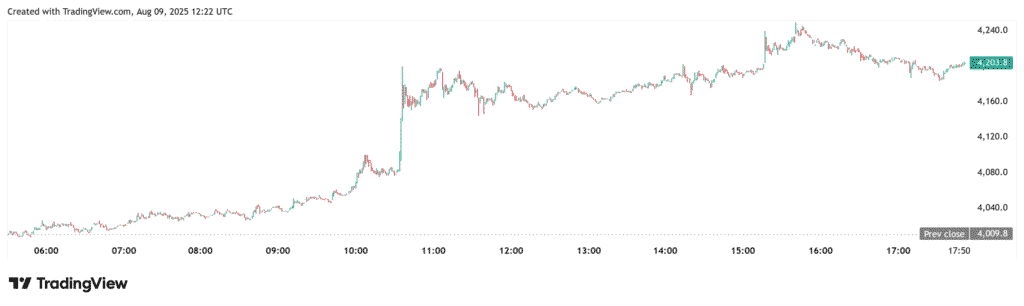

According to market data, ETH touched $4,023 in Asian trading on August 8, before settling slightly lower. The move comes amid rising investor interest in altcoins, even as Bitcoin’s dominance starts to cool off.

Big Buyers Back in the Market

Blockchain data shows significant whale activity driving the surge. On-chain tracker Lookonchain reported that one large investor bought 1,390 Wrapped Ether (WETH), deposited it on lending platform Aave, borrowed more WETH, and converted it into ETH.

In a separate transaction, another whale purchased 10,400 ETH—worth around $40.5 million—in an over-the-counter deal.

Adding to the bullish mood, Fundamental Global Inc. filed plans for a $5 billion shelf offering to buy ETH and related assets.

Analysts See Bullish Cycle

Crypto analyst Rekt Capital noted that Ethereum’s market dominance is halfway through a similar uptrend cycle to the one seen in 2021, which led to major price gains. Traders believe that if the pattern continues, ETH could see further upside in the months ahead.

Altcoins Follow the Rally

The surge in Ether also lifted other altcoins.

- XRP rose around 9%

- Solana (SOL) gained about 3.5%

- Dogecoin (DOGE) climbed nearly 5%

Ether-focused stocks also reacted positively. Companies like Bitmine Immersion Technologies and SharpLink Gaming posted gains as crypto sentiment improved.

Market watchers are now looking to see if ETH can hold above the $4K level. A sustained breakout could attract more capital from Bitcoin into Ethereum and other altcoins, extending the current rally.

Also Read: SEC Crypto Task Force Tour begins U.S. outreach to small crypto startups